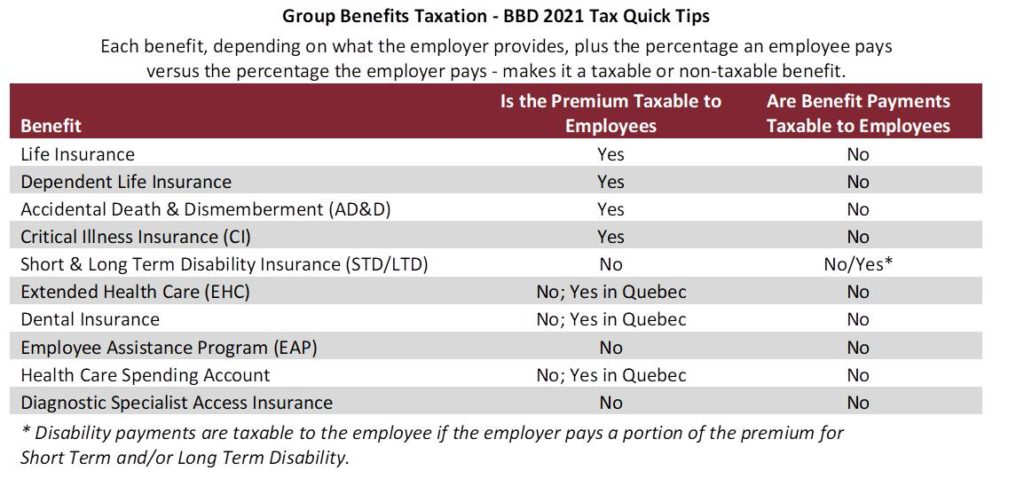

Health Care Spending Accounts (HCSA)

A HCSA is a non-taxable enhancement to a group benefits plan that is already in place. It provides employees with flexibility and allows them to individually determine what to spend this additional dollar amount on based on their needs. It is a flat amount per calendar year per insured employee, and typically can be carried over if unused within the year it was provided. It covers any medical expenses listed on CRA’s website, including topping up paramedical and dental expenses that were not reimbursed by the base plan.

Click here for a detailed list on which medical items an HCSA can cover: Lines 33099 and 33199 – Eligible medical expenses you can claim on your tax return – Canada.ca

If you are interested in learning more information about Health Care Spending Accounts or the taxation of employee benefits, please contact us at 250-763-6464 and our dedicated team will be happy to assist you!